In addition, free IRS filing platforms such as Free File Fillable Forms will provide digital copies. Last, some public courthouses or Federal buildings in your community may offer paper copies available for pick-up. Before 2019, there were shorter versions of Form 1040 for filers with simpler returns. These were Form 1040EZ and 1040A, but they no longer exist. However, taxpayers age 65 and up may be able to file using Form 1040-SR.

- Before 2019, there were shorter versions of Form 1040 for filers with simpler returns.

- While the 1040 relates to the previous year, the estimated tax form calculates taxes for the current year.

- This way, users of the data would not have to wade through successive pages and attached Supporting Statements to find that out.

- There are many different types of Form 1099, but Form 1099 is most commonly given to independent contractors to remit tax information relating to payments they received during the tax year.

- The latest versions of IRS forms, instructions, and publications.

The agency requested a budget of $14.1 billion for the 2023 fiscal year and requested that the allocation structure be changed so that money can be moved to support costs in other areas. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more.

Income Tax Calculator: Estimate Your Taxes

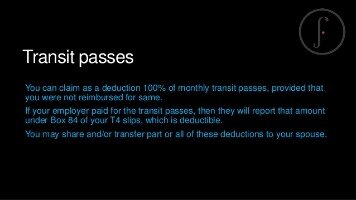

An action taken to lessen tax liability and maximize after-tax income. A tax on imported goods levied primarily to generate revenue for the federal government. Includes taxable and tax-exempt interest, dividends, capital gains net income, certain rent and royalty income, and net passive activity income.

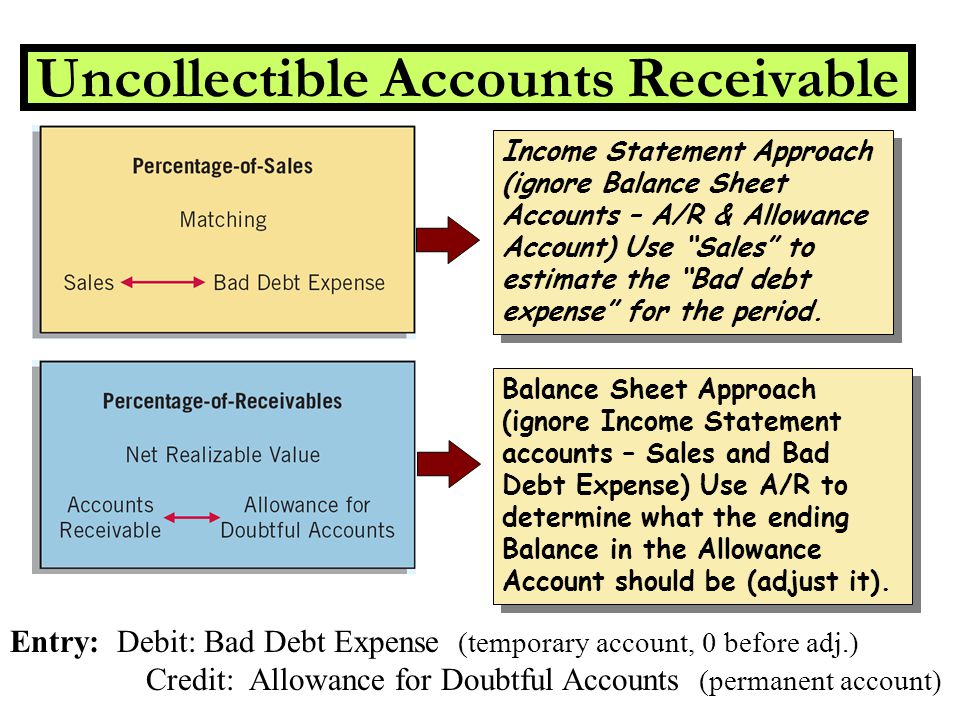

Any input from Schedule A is entered into Line 12a on Form 1040. Another part of Schedule 2 is used to report self-employment taxes, Medicare taxes, taxes on individual retirement accounts , household employment taxes, and other taxes. These two parts from Schedule 2 are reported on Line 17 and line 23 on Form 1040. An additional deduction may be taken by those who are age 65 or older or blind. Just like the standard deduction, these figures are adjusted annually for inflation. If a filer makes a mistake or forgets to include information on any 1040 form, Form 1040-X is used for making changes to previously filed 1040s.

NTA Blog: The IRS Must Be Proactive in Issuing Timely and Clear … – National Taxpayer Advocate

NTA Blog: The IRS Must Be Proactive in Issuing Timely and Clear ….

Posted: Thu, 09 Feb 2023 08:00:00 GMT [source]

With better data, the IRS and policymakers will have a better idea of problem areas of the tax code, those which impose undue time and expense burdens relative to the amount of taxes they collect. Approximately one-third of people who receive Social Security are required to pay taxes on their benefits. Your filing status and income level will determine whether your Social Security payments are subject to tax. In general, your benefits are not considered taxable as long as Social Security is your sole source of income. You can access this form directly at this link and file it yourself. If you are working with a paid tax preparer or CPA, they will likely take care of this for you but confirm it has been filed.

Penalty for Underpayment of Estimated Tax

Money and goods received for services performed by food servers, baggage handlers, hairdressers, and others. Tips go beyond the stated amount of the bill and are given voluntarily. Tax-exempt interest income is earned from bonds issued by states, cities, or counties and the District of Columbia. Reduces the income subject to tax and varies depending on filing status, age, blindness, and dependency. The self-employment tax rate is 15.3 percent of self-employment profit. The self-employment tax is calculated on Schedule SE—Self-Employment Tax.

She has 20+ years of experience covering personal finance, wealth management, and business news. Money-making activities that people don’t report to the government, including both illegal and legal activities. The process that occurs when a tax that has been levied on one person or group is in fact paid by others.

Daniel has 10+ years of experience reporting on investments and personal finance for outlets like AARP Bulletin and Exceptional magazine, in addition to being a column writer for Fatherly. To qualify for a short-term plan with the IRS, you must owe less than $100,000 between your tax bill, penalties, and interest. Profit and prosper with the best of expert advice – straight to your e-mail. However, no single factor determines whether or not the IRS will audit you. The IRS website has a locator page into which you merely type your ZIP code to get the office location and phone number.

Self-employment taxes done right

Have additional income, such as unemployment compensation, prize or award money, gambling winnings. Have any deductions to claim, such as student loan interest deduction, self-employment tax, educator expenses. Form 1040 is not a tax statement or form that gets distributed to taxpayers. Unlike a W-2 or 1099 statement that is mailed by an employer or party you’ve contracted with, Form 1040 is available for download on the IRS website.

What to do if you receive an IRS balance due notice for taxes you … – National Taxpayer Advocate

What to do if you receive an IRS balance due notice for taxes you ….

Posted: Fri, 22 Jul 2022 07:00:00 GMT [source]

Office of Information and Regulatory Affairs along with Supporting Statements prepared by each federal agency. NTUF tallies up the burdens for 465 IRS information collections . He cumulative time spent each year on taxes stretches out to over 747,000 years. With the average 77-year life expectancy of an American, the amount of time devoted to tax compliance this year alone would consume 9,700 human lifetimes. The first Homo Sapiens appeared around 300,000 years ago, so. 747,000 years is more than double the amount of time our species has been on the planet.

By Phone or Online

To avoid this penalty, you can use your previous year’s taxes as a guide. In many cases, as long as you pay 100 percent of the previous year’s tax, you won’t be subject to the penalty. If you end up overpaying, you can receive a tax refund at the end of the year or carryover the excess amount to help pay the estimated taxes for the next year. The IRS provides Form 1040-ES for you to calculate and pay estimated taxes for the current year. While the 1040 relates to the previous year, the estimated tax form calculates taxes for the current year. You use Form 1040-ES to pay income tax, self-employment tax and any other tax you may be liable for.

We can calculate the value of this burden using average private sector labor costs – which rose by 5.6 percent since a year ago – as a $260 billion per year time drain. Not all taxable income is set up so that taxes are deducted at the source. Independent contractors and freelancers, for example, typically do not have tax deducted from their pay. If you have any of theses types of income coming in, then you might need to pay estimated taxes during the year.

Used to provide medical benefits for certain individuals when they reach age 65. Workers, retired workers, and the spouses of workers and retired workers are eligible to receive Medicare benefits upon reaching age 65. The recipients of the services do not control the means or methods the independent contractor uses to accomplish the work. The recipients do control the results of the work; they decide whether the work is acceptable. Completed by the employee and used by the employer to determine the amount of income tax to withhold. A tax credit for certain people who work, meet certain requirements, and have earned income under a specified limit.

For 2020 and 2021, a line was added for charitable contributions of cash for those that took the standard deduction. TurboTax will do this calculation for you and recommend whether choosing the standard deduction or itemizing will give you the best results. Schedule E is used to report various types of additional income or losses. This supplemental financial activity ranges from real estate rental income, royalties, partnerships, estates, trusts, and residual interests in real estate mortgage investment conduits.

The income tax was originally enacted in 1913 at just 27 pages long. Amendments, regulations, and judicial rulings shortly after passage grew the code to 400 pages. You can’t claim the credit if your modified adjusted gross income is over $90,000 ($180,000 for joint filers). Passive losses cannot be deducted from active income, which can be a thorn in the side of many small business owners.

The income a person receives from certain bank accounts or from lending money to someone else. The simultaneous increase of consumer prices and decrease in the value of money and credit. A tax that can be shifted to others, such as business property taxes.

how to calculate stockholders equity 1040 is the standard federal income tax form used to report an individual’s gross income (e.g., money, goods, property, and services). It is also known as “the long form” because it is more extensive than the shorter 1040A and 1040EZ Tax Forms. Also unlike the other tax forms, IRS Form 1040 allows taxpayers to claim numerous expenses and tax credits, itemize deductions, and adjust income. While the 1040 may take longer to complete, it benefits taxpayers by giving them more opportunities to lower their tax bills. Form 1040 is the standard Internal Revenue Service form that individual taxpayers use to file their annual income tax returns. The form contains sections that require taxpayers to disclose their taxable income for the year to determine whether additional taxes are owed or whether the filer will receive a tax refund.

This is determined on Form 1040 Schedule E, and is defined as any income or loss that occurred without active engagement. Limited partnerships are one example, in which an individual might not actively manage a firm but still own a percentage. Ownership would transfer passive income or losses onto your AGI but not MAGI. You can avoid filling out Form 1040-V, and ensure that your payment is processed more quickly, by paying through the secure IRS webpage.

A concept of tax fairness that states that people with different amounts of wealth or different amounts of income should pay tax at different rates. Wealth includes assets such as houses, cars, stocks, bonds, and savings accounts. Income includes wages, interest and dividends, and other payments. You don’t have to pay estimated tax for the current year if you meet all three of the following conditions.

File your federal tax return by the tax deadline or file for a tax extension. That way, you avoid a failure-to-file penalty, which would unfortunately increase your tax burden if you already owe. In some cases, if there’s a good reason why you can’t pay your taxes on time, you may be able to get penalty relief from the IRS. But there are restrictions on what counts as a “good reason,” so this is not as easy as it might seem. In 2017 the hourly tax complexity burden stood at 8.06 billion hours.

Schedule D is used to report taxable income from the sale or exchange of a capital asset. This gain may have arisen from an exchange or an involuntary conversion. Schedule D is also used to report capital gain distributions not otherwise reported on Form 1040 as well as nonbusiness bad debts. An activity qualifies as a business if the taxpayer is engaged in the activity for the primary purpose of producing income or profit. The activity is also considered a business as long as the taxpayer is involved in the activity with regularity and continuity. Schedule B is used for taxpayers who received greater than $1,500 of taxable interest or ordinary dividends.

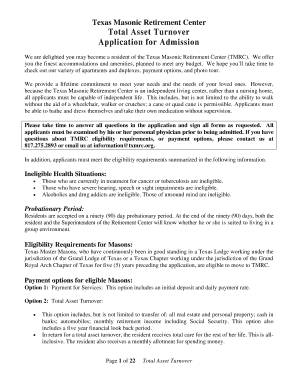

The form must include the taxpayer’s name, taxpayer identification number, address, and the amount owed. If filing jointly, the taxpayer must also include their spouse’s SSN. When you owe more than $25,000, the IRS requires you to make payments through automatic withdrawals.

Keep in mind that the agency does not endorse any particular platform or filing software. The tax preparation software works with the IRS electronic filing system. The transmission of tax information directly to the IRS using telephones or computers. Electronic filing options include Online self-prepared using a personal computer and tax preparation software, or using a tax professional. Electronic filing may take place at the taxpayer’s home, a volunteer site, the library, a financial institution, the workplace, malls and stores, or a tax professional’s place of business.

.jpg)

.jpg)